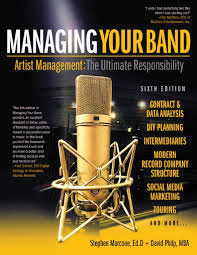

The following article is taken from the book Managing Your Band, Artist Management: The Ultimate Responsibility, 6th Edition, by Stephen Marcone and David Philp (Hal Leonard Corporation). The book is a resource for any musician working in the music business. It covers data analysis, planning, modern record company structure, social marketing, touring, and more.

The following article is taken from the book Managing Your Band, Artist Management: The Ultimate Responsibility, 6th Edition, by Stephen Marcone and David Philp (Hal Leonard Corporation). The book is a resource for any musician working in the music business. It covers data analysis, planning, modern record company structure, social marketing, touring, and more.

Bands often begin performing and making money before they become an actual business. However, when the group begins to purchase equipment as a band they must eventually become a business. The first step in establishing your business is deciding what type you should create. The most common types of business entities are: proprietorship, partnership, corporation (in various forms), and limited liability company.

Proprietorship

A proprietorship is the simplest and the easiest form of business to start. By definition, it is a business conducted by one self-employed person who is the owner. Contact your county clerk for specifics, but most likely you will need to:

1) File a DBA (Doing Business As) form (found online) with the county clerk in the county where you’ll conduct business. (This is unnecessary if you intend to do business in your own name.)

2) You may be required to publish a DBA legal notice in the local newspaper.

3) File an Internal Revenue Service Form SS-4 to obtain an employer’s tax ID number (even if you have no employees).

4) If you intend to sell (retail) goods, you must obtain a resale tax permit from the state tax authority.

5) Open a company checking account.

With a proprietorship you have complete control of all decisions and earn all the profit. However, you are personally liable for any accidents or lawsuits that might occur and you also absorb any losses. Creditors may place a lien on your personal property. There are also tax issues involved, so it’s best to consult an accountant.

Partnership

There are several types of partnership:

General Partnership—Two or more partners contribute (or loan) property, service, and/or money to the business. Each partner owns an interest in the whole partnership (assets in common) and acts on behalf of the partnership. The entire general partnership is responsible for any lawsuit, except where bodily harm or injury has occurred. In the event of losses, the general partnership assets are liquidated before creditors can access an individual partner’s personal property. Setting up a general partnership is similar to setting up a proprietorship. An attorney should compose the actual terms of the agreement.

Joint Venture—A group and an entrepreneur join together to complete a project (writing a song or producing a master recording). Once the project is complete there is no reason for the relationship to continue. They are actually in a partnership for that one business transaction. One party is contributing service and one party is contributing service or money.

Limited Partnership—A limited partnership is created to fund a business project. A general partner takes on the normal business responsibilities, and the limited partner contributes capital but takes no part in business management and has no liability beyond the investment. The limited partner acts as a backer to finance a project (usually for a limited time). State and Federal security laws govern limited partnerships, and an attorney should be consulted.

Limited Liability Partnership—This type of partnership protects individual partners from personal liability for the negligent acts of other partners or employees not under their direct control. These companies are most common among law firms.

Corporation

A corporation is a separate business entity from the persons who manage it. Ownership is obtained by buying shares of stock in the corporation. Personal assets of individuals are protected from creditors. Corporations can be public (stock traded on a stock exchange) or private (stock not available to the open market). In a private corporation all shareholders have some relationship to the business. Most bands keep their corporations private.

There are two types of corporations: “C” and “S.” “C” corporations provide shareholders with the most protection from liability and responsibility from debts and contracts. Profits for “C” corporations are taxed at the corporate level and at the shareholder level when distributions are made. “S” corporations also provide shareholders with protection from liability, but are exempt from federal income tax. The income/loss is passed through to the shareholders and the taxes are paid at the shareholder level.

Limited Liability Company (LLC)

The LLC allows members to enjoy the tax benefits of a partnership and the limited personal liability of a corporation. However, it does not exempt members of the company from being sued for negligence. States vary as to the criteria for forming an LLC. You and/or an attorney should be able to set one up for under $1,000. Each member is issued shares in the company and signs an operating agreement.

In the world of songwriters, touring acts, entertainers, and musicians, the two most commonly used entities are the “S” corporation for touring and Limited Liability Companies. When forming a corporation, an attorney and an accountant should be retained. There are many legal obligations, such as tax and labor laws, which must be followed.