As an officer of the Federation who is also a trustee of our Pension Fund, I am devoting this column to the Pension Fund. Like all of you, I am concerned about the safety of my pension and, like you, I am worried about the Pension Fund’s future. But I assure you that every member of the Board of Trustees is doing our best to protect and preserve the Pension Fund into the future. Please know that the opinion I express here is solely my own and I do not speak on behalf of the other trustees or the fund.

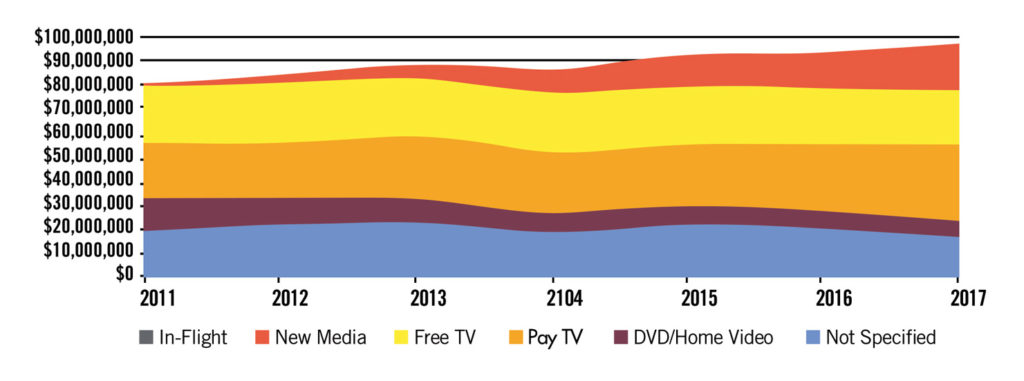

When I became a trustee in August 2010, the fund was beginning its efforts to rebalance its finances and repair the damage done by the 2007-2009 recession. On March 31, 2009, we had an $800 million gap between the pension benefits already earned by members—that is, our liabilities—and the market value of our assets. Over the next five years, the market value of the assets increased by $500 million to $1.8 billion, but our liabilities also increased, by $300 million to $2.4 billion, narrowing the gap between our assets and liabilities by only $200 million (from $800 million to $600 million). That is the single biggest issue facing the Pension Fund.

In 2014, our actuaries provided an Asset-Liability Modeling Study that showed that over a 20-year period, our liabilities were projected to increase dramatically, such that even if we achieved our 7.5% investment return assumption, our funded percentage would be below 50% by 2034 and there would be a serious risk of future insolvency. On the other hand, the study showed that an investment allocation with a higher investment return target would reduce the probability of future insolvency. After lengthy discussion, the trustees increased the allocation of investments to some with the potential for higher returns, recognizing that an investment mix with a higher return potential (albeit with accompanying higher volatility) reduced the probability of insolvency. One of the investments we hoped would give us part of the additional return did not achieve its expected results (although today it is one of the highest performing asset classes in the portfolio). This widened the gap.

So, we have a very serious imbalance in our finances. While there are other contributing factors that exacerbate our situation—the loss in union membership (and corresponding contributions) that mirrors the decline in our participant base; the aging of our population (common among all mature pension funds) reflected in the increase in pensioners and their longer lifespans; and the growing amount of work not done under union contract—the increasing size of this gap between assets and liabilities is the most critical problem we have to solve. Resolving it is essential to our survival.

As an International Executive Officer I participate fully in the AFM’s legislative and political activities. Matters concerning federal legislation are overseen by AFM President Ray Hair and his legislative aide, Alfonso Pollard. I have worked with them consistently regarding the pension bills that have already been submitted, including the Butch Lewis Act introduced by Sherrod Brown and endorsed by the Federation. The Pension Fund’s actuaries are currently reviewing that bill to confirm that it would help the fund. If so, I will urge my fellow trustees to fully support the bill, and I have every reason to believe that they will enthusiastically do so.

In the meantime, absent new legislation, the only way to address the imbalance between our assets and liabilities is to reduce the liabilities in a manner consistent with current law: the Multiemployer Pension Reform Act (MPRA). If the fund enters “critical and declining” status, the MPRA allows the trustees to apply to the Treasury Department for approval of an equitable plan of benefit reductions. Should such reductions become both necessary and legally allowable, that plan would be designed consistent with the strict requirements of the law to reduce benefits of those under 80 and those not disabled, but in no case below 110% of the PBGC guarantees. If a participant’s benefit is already below the PBGC guarantee, that benefit cannot be reduced further.

Since it is unlikely at the moment that investment returns alone will resolve these funding issues, the other trustees and I must consider MPRA restructuring in order to preserve the Pension Fund, reducing benefits for some in order to maintain the viability of the fund for all. While once the fund could afford to pay the high benefits it promised to some of us, it can no longer afford to do that, and recognizing and addressing that fact appears at the moment to be the only option to preserve the fund and as much of our benefits as possible. Since benefit restructuring under the MPRA cannot reduce benefits below the PBGC guarantees, it is clearly preferable to relying on those PBGC guarantees, particularly in light of the PBGC’s own impending insolvency in 2025.

I urge all members to register on the Pension Fund’s website and carefully review the information we post there. We are committed to keeping you informed.