As we enter the fifth month of the pandemic, the live entertainment industry is still shutdown. With Depression-era unemployment and with the virus out of control, no one knows when it will be safe enough to reopen our performance venues, to end this isolation, reconnect with our audiences and with each other.

In this period of radical uncertainty, many believe the pandemic will cause shifts in political and economic power that will only become clear later. The Congressional Budget Office has estimated that the US unemployment rate will stay above pre-pandemic levels for a decade, predicting that unemployment in the fourth quarter of 2030 will be 4.4%. The February pre-pandemic unemployment rate was 3.5%, a 50-year low. Current projections of 14% unemployment for the fourth quarter this year do not reflect the resurgence of virus cases that have led many states to re-impose restrictions and scale back reopening plans.

As I write today, July 16, over 50 million people have filed for unemployment benefits, putting the real unemployment rate near the Depression-era peak of 25%. With a V-shaped recovery considered unlikely, a growing number of scientists, politicians, and economists say that controlling the virus is the key to economic recovery.

All of us are under an enormous amount of stress due to the economic effects of the pandemic, which are also viewed against the background of pandemic politics. We see politicians deciding whether to risk tens, maybe even hundreds of thousands of lives on the one hand, or whether to risk the economy on the other. But as the agony of the pandemic plays out, the economy is stalling during the reopening process with exponential spread of the disease.

There is misery on either side of the equation. The lockdowns have given rise to tens of millions of unemployed, a rash of bankruptcies, and severe financial pain. But there is also an extended period of suffering when opening the economy too soon results in a rebound in infections. With science saying a full year of pandemic infectiousness is looming, even with the discovery of a vaccine, additional government intervention and economic assistance is needed.

The Federation played an important role in the lobbying process toward initial emergency supplemental COVID legislation in March, which gave state unemployment programs the latitude to pay freelancers and gig workers unemployment benefits. The added federal boost to state payments of $600 per week was expected to end (as of this writing) the last week of July.

We are lobbying hard to extend those payments. We know that it is likely, due to the non-essential nature of our employment, that for the entertainment industry and for musicians in particular, both for regularly employed and for freelancers, the devastation to our business may result in our being among the last to return to work. Returning to anything resembling pre-COVID working conditions looks more and more distant.

In March, the government enacted a four-month legislative economic relief program that included expanded unemployment benefits, small business assistance, tax-filing delays, and eviction moratoriums. But in light of the virus resurgence that is choking the restarting of the economy, it won’t be enough.

New York Governor Andrew Cuomo’s early aggressive intervention both saved lives and led to a quicker rebound to help rebuild demand for jobs. The New York approach, which imposed a short-term lockdown and solid social distancing measures, got control of the infection rate and limited the spread of the disease. Governor Cuomo saw it necessary to mitigate the deadly impact of the virus because he believed and clearly understood that without a healthy population, there can be no healthy economy.

More governmental aid is necessary not just for our unemployed, but also for the small and medium-sized businesses that employ us. Without it, you can expect many more businesses to file bankruptcies, which will cascade through and crash the financial and real estate markets. Banks will be in trouble if business debt is not serviced. Landlords will not get rental payments, which will lead to additional bankruptcies, debt charge offs, and more banking sector problems. And if we can’t enable the scientists to find ways to treat and contain the disease quickly, more people will get sicker, more companies are going to crash, and this shaky, sputtering economic reopening will regress further.

What we can do today is what we did in March. We can contact Congress, particularly the Senate, to demand action to aid the unemployed, including gig workers and professional musicians whose jobs disappeared overnight, and whose loss of work has no end in sight.

In May, the US House of Representatives passed the HEROES Act, which would extend expanded unemployment benefits through January 2021. But the Senate has still not voted on this critical piece of legislation. I contacted my senators to tell them to support critical pieces of the HEROES Act in the next COVID-19 relief bill including:

- Extending Pandemic Unemployment Compensation, which provides an additional $600 per week to the unemployed.

- Providing a 100% COBRA premium subsidy for lost access to employee-based insurance.

- Safeguarding renters and homeowners from evictions and foreclosures.

- Providing assistance to struggling multiemployer pension plans, including the AFM plan.

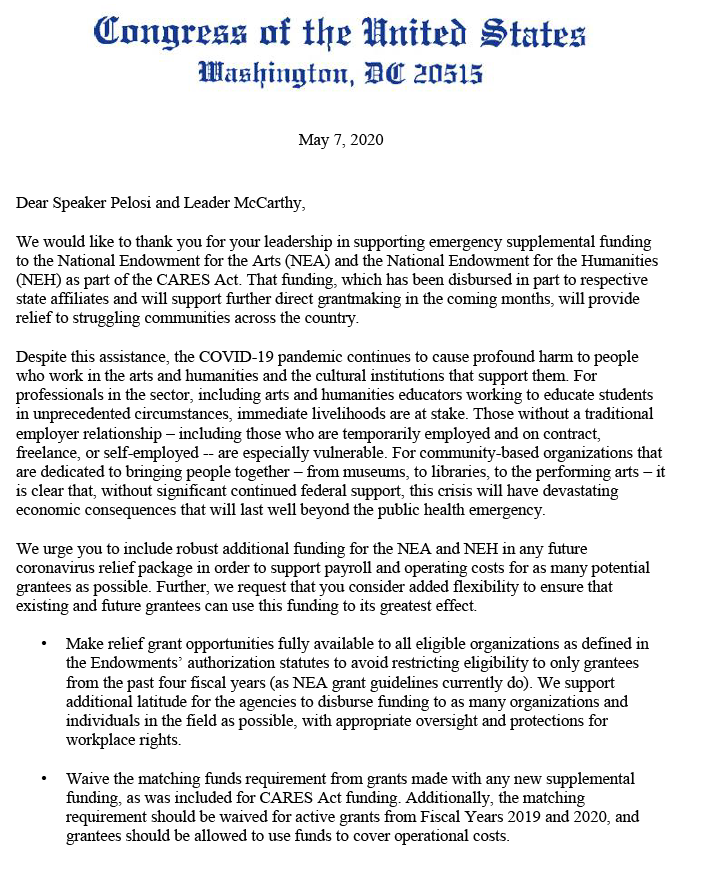

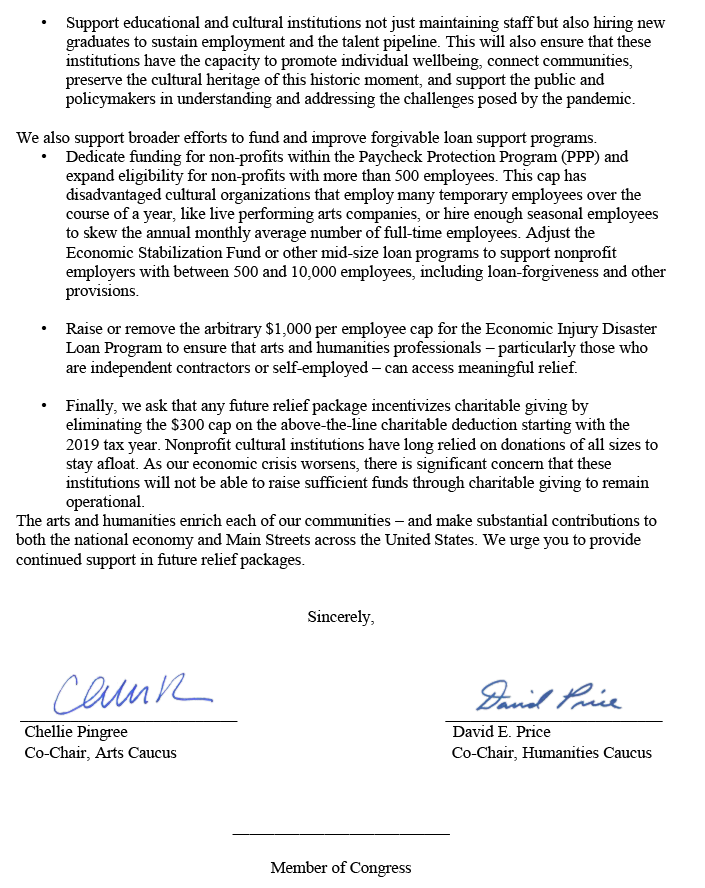

- Increasing funding for the National Endowment for the Arts and other arts organizations.

- Additional financial aid for small businesses.

Will you join me in writing to our senators now? Please copy the following link and follow the prompts:

https://actionnetwork.org/letters/tell-the-senate-to-extend-unemployment

Our health and livelihood, and that of our families and friends, and reducing short- and long-term consequences of this terrible pandemic may very well depend on what happens in Congress between now and August 8, when the Senate is scheduled to recess. Again, please visit the link above and urge your two senators to support our interests. Don’t wait. Please do it today!