by Claire Stefani

Playing any instrument means moving a lot. Musicians make a number of physical adjustments to play, often at the expense of optimal body mechanics. Given the asymmetric position of playing a violin or viola, properly fitted ergonomic solutions are critical to a healthy body and optimized posture. It is important to find the appropriate equipment for your body and periodically check that it’s still the best solution for you. Here are some tips from a chinrest fitting expert.

Head Balance—Keeping the head balanced and free to move is critical. Chinrest height should permit the head to rest in a neutral position at the low point of nodding “yes,” but free to move laterally (shaking the head “no”). Some chinrests provide ergonomic benefits such as additional height or left/right tilt. Some custom models allow musicians to lower their instrument and rest it partly on the collarbone in a neutral head position.

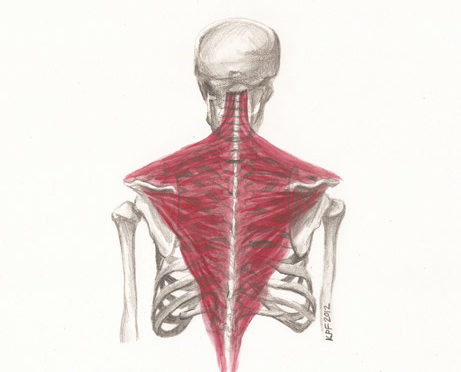

Arm Balance—If not supported by the torso muscles, arms will hang and pull the instrument downward. If a musician is not keenly aware of back and shoulder muscles, especially in the development of arm support, any attempt to adjust the chin/shoulder rest setup to counterbalance this downward weight will only put more stress on the head and left shoulder. Also, work at allowing the shoulder blade to immediately follow the humerus while shifting and bowing—similar to how the femur swings freely from the hip joint when walking.

Instrument Position—Up or down, in or out, is an individual preference. The chinrests or shoulder rests should not dictate instrument position. By allowing the instrument to lean on the collarbone, instead of only on the left shoulder, you are less likely to clench, and will have more freedom in the left shoulder, as well as in the bow arm.

Shoulder Rests—Once the head is balanced, muscular work is redistributed throughout the torso to better support arm weight, and the left shoulder is relieved from its static role, you can determine what equipment, if any, to use under the instrument. A shoulder rest can result in overall stiffening of the entire left shoulder, but playing without one can lead to distress throughout the upper body. Changes may need to be progressive. Keep in mind:

- If a shoulder rest is too squishy, it may encourage clenching.

- Models designed to lean just below the contour of the collarbone prevent downward pressure over the left shoulder.

- Anti-slip surfaces may add to comfort, especially when shifting to and from high positions.

Seating—Much of your playing is likely done sitting. Wedges, pads, and stools mounted on a convex base allow a slight pelvic tilt resulting in psoas muscle release. This pelvic tilt will improve awareness of balance around your lumbar core and address lower back pain linked to postural issues or ill-fitted chinrest/shoulder rest setups.

Listen to Your Body—Pain or fatigue often come from muscle tension. It is important to identify any postural imbalance in playing position (versus neutral position)—leading muscles to sustain a static position, instead of contributing to movement. Say “No!” to the mantra “no pain, no gain.” Pain only leads to injury!

Claire Stefani is a fitter for the Frisch and Denig chinrest line, she has helped more than 400 musicians with their setup. She is founder of Volute Service International and amateur chamber music violist and violinist in New York City, an affiliate Andover trainee, and an active member of the Performing Arts Medicine Association.